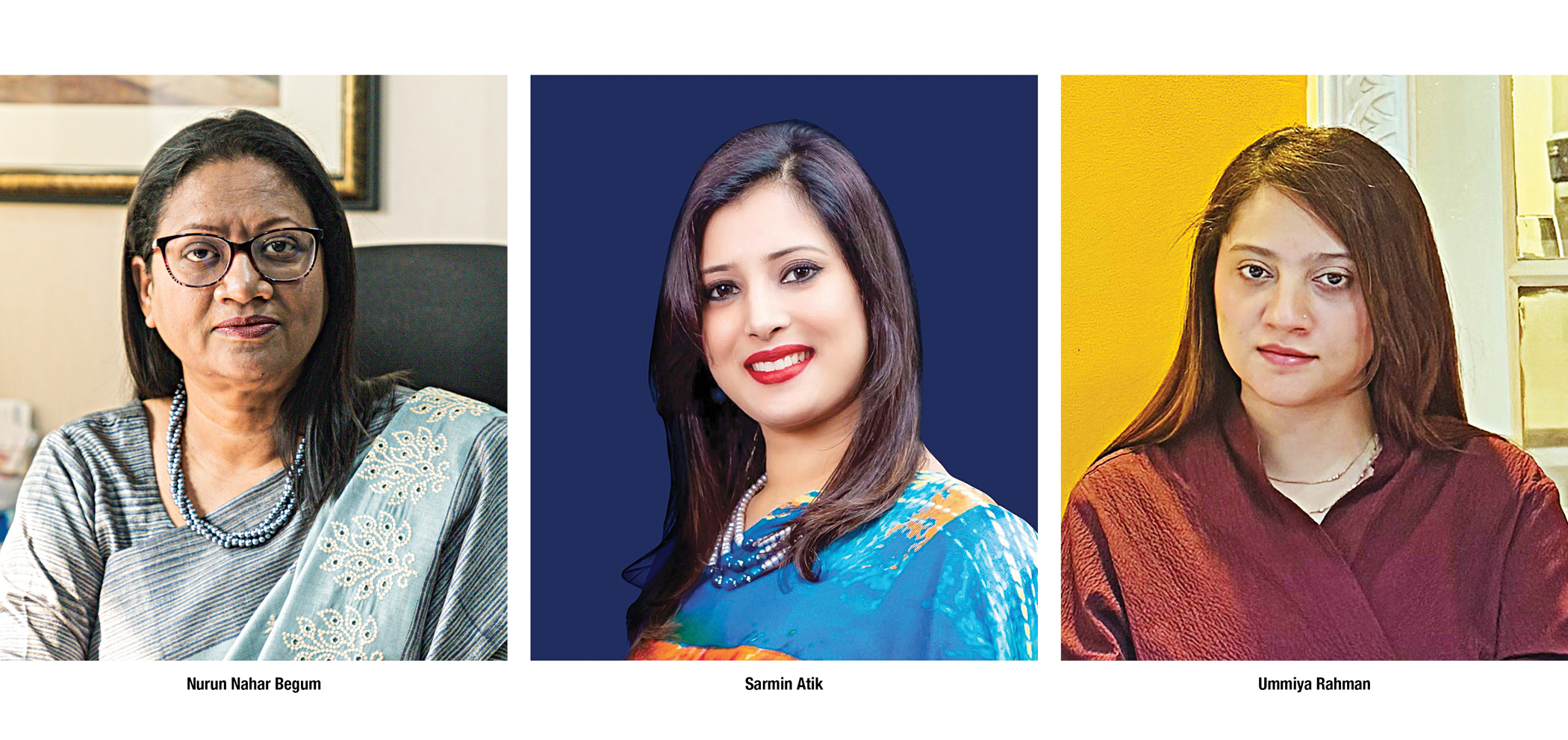

How female leaders are shaping a new era in banking

Across Bangladesh’s financial landscape, a decisive revolution is underway where women are shaping the rules, questioning traditional systems, and introducing leadership styles grounded in empathy, resilience, and most importantly, inclusivity. The banking sector is gradually becoming multidimensional, thanks to subtle changes: an inclusive maternity policy here, a shift in customer communication there, and the impact is substantial. At the centre of this evolution are women in roles from branch managers to C-suites, who are bravely navigating a world not designed for them, but they are rebuilding it with more nuance and ambition than ever before.

A childhood of circuits and curiosity

For Nurun Nahar Begum, now the Chief Technology Officer of BRAC Bank PLC, the journey into the banking world began with light bulbs, radios and circuit breakers.

Begum’s fascination with technology began when it was far from accessible and computers were rare. She had a personal computer at home by the early nineties, and the machine changed the direction of her academic life. Although Begum completed her Master’s in Finance and Banking, she realised she needed to study more about technology. She went on to complete a year-long programming diploma at a time when few women in Bangladesh even knew what programming meant.

In every respect, her family supported her. “I never heard anyone in my family say you cannot do this or that. They simply told me to study diligently and do something with my life,” she shares.

And when Begum joined BRAC Bank, it was already fully digitised.

“I am not great at sales, and when I joined the bank, I had the option to choose a branch role or move into technology. I am a problem solver, and like understanding things end-to-end, so I chose technology, as it allows me to do that,” she elaborates.

Begum started her career from the lowest grade, and now, she holds the highest: the Division Head. Her decisions have impacted the bank’s digital journey. And her leadership? It has certainly opened doors for women who rarely envisioned themselves in tech.

A path to banking, not by design

In another corner of Bangladesh’s banking universe sits Sarmin Atik, Executive Vice President and Head of Liability and Wealth Management at Eastern Bank Limited.

“My father was a banker, so maybe that planted an early seed. But I never planned on becoming a banker,” Atik shares. Though she stepped into the industry by chance, here she discovered purpose.

Atik began her journey 21 years ago, and back then, women in leadership were rare. However, today, she sees the shift clearly. So, what might the changes be?

“If you ask me, I would say that now women in banking are more active, focused, and balanced. We support one another, and that solidarity has transformed our presence,” she answers.

Yet, she sincerely acknowledges something often left unsaid.

“Without the support of the men in our lives, our fathers, husbands, and colleagues, many of our journeys would have been more difficult. I honestly believe that real progress is never one-sided. It happens when men and women move forward together,” she says.

For Atik, real leadership means not having the loudest voice in the room but creating more voices around her. For her, emotional intelligence carries the utmost importance, not as a soft add-on, but as a core financial tool.

“I think a good leader always uplifts others by giving them space to grow and celebrating their wins wholeheartedly. Numbers matter, but only tell a part of the story. It is the people who always complete the story,” Atik acknowledges.

And her message to the young women entering the banking sector?

“Ups and downs will always be there. Remember why you started. Trust your journey.”

Decoding people, defining brands

In the fast-paced intersections of fintech and brand strategy, Ummiya Rahman, SVP, Brand Strategy and Consumer Insights, Brand Marketing of bKash, is attempting to reshape the way financial services speak to people.

Not in a marketing classroom, but in engineering labs and telecom offices, Rahman’s fascination with the minds using the machines began. “I kept asking how the solutions we build contribute to shaping behaviour? I believe that strategy comes from not merely knowing what people do, but why they do it in the first place,” she explains.

A shift into advertising exposed her to insights, brand psychology, and the subtle architecture behind habit formation. That foundation shapes Rahman’s work at bKash today.

With time, Bangladesh’s financial landscape has become quite crowded, and today, most features promoted by companies mimic each other. In this scenario, what differentiates one brand from another is not only technology but also understanding human behaviour.

“If I have to explain brand strategy in my own terms, I would call it a mix of behavioural science, data, and creativity. Because, you see, real brand building starts long before execution,” Rahman elaborates.

When asked about the biggest challenge of her early career, she answered, “It was, I think, keeping pace with an industry transitioning rapidly into digital and data-led decisions. If I had to stay relevant, I needed to continuously learn and unlearn.”

Today, she mentors young marketers who often mistake speed for impact.

Rahman’s reflections on women in leadership echo a promising shift in the financial sector. “More women are shaping strategy and influencing decisions than ever before. But sustaining this progress requires environments where women feel supported to grow,” she says.

Rewriting the culture of banking

The thread that ties the trajectories of these three extraordinary women is not merely gender, but their agency and determination to bring about visible changes. All of them entered an industry that has been mostly male-dominated and tried their best to rewrite the organisational culture that promotes inclusivity.

There is no denying that Bangladesh’s banking sector is now more technologically ambitious and aligned with global thinking than ever before. Here, women are creating environments where collaboration replaces competition, and these three progressives are shining examples.

Because for the first time, the question is no longer “Can women lead in banking?” They already are. The real question is, what will the next generation build on top of what these women have begun?

Photo: Nafis A Khan / Courtesy

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments