App-based banking gains traction as customers go digital

Banking is no longer limited to brick-and-mortar branches. People are banking remotely using the internet more and more. Of late, mobile applications have come up as a new and inviting option, and a growing number of customers are using apps for banking in Bangladesh.

In November, 85.7 lakh customers used mobile apps to do banking, up nearly 13 percent from 76 lakh a month ago, thanks to the fast adoption by women customers, according to Bangladesh Bank (BB) data. In June, 71.66 lakh customers used mobile apps.

Bankers find this scenario to be part of a broader shift of people towards automation and digitalisation of various services.

Mobile apps now place most banking services directly in customers’ hands, significantly reducing the need for branch visits, said Ali Reza Iftekhar, MD of Eastern Bank

“App-based banking in Bangladesh is expanding rapidly as customers increasingly depend on digital channels for everyday financial needs. Widespread smartphone adoption, improved mobile internet access, and a strong preference for faster, convenient, and 24/7 banking services have accelerated this shift,” said Ali Reza Iftekhar, managing director of Eastern Bank PLC.

In a written reply, he said mobile apps now place most banking services directly in customers’ hands, significantly reducing the need for branch visits.

“With nearly all private commercial banks offering app-based banking, digital transactions have surged, benefiting both customers and banks. Busy lifestyles, growing trust in digital payments, and the widespread use of smartphones are also accelerating Bangladesh’s transition towards a more cashless, digitally driven economy.”

The private bank’s app, EBL Skybanking, has half a million users, and it processed over half a trillion taka in transactions across digital and “phygital” channels such as ATMs and CRMs.

This growth is further supported by a 79 percent year-on-year increase in average transaction numbers, a 90 percent rise in average transaction volume, and a 59 percent growth in digital youth users.

“This clearly indicates the rapid expansion of internet banking at EBL.”

The BB said the number of customers taking financial services through internet banking is on the rise, too. However, overall transactions through internet banking dropped 12 percent to Tk 1,07,993 crore from the previous month.

Despite the fall, overall transactions through digital platforms have been staying over Tk 1,00,000 crore for six months since June 2025.

The BB said 58 out of 61 banks are now providing services through the internet.

Sending money to mobile financial services is the biggest form of transaction through the internet, followed by cash withdrawal, various payments, including bills, and mobile recharge, according to BB data.

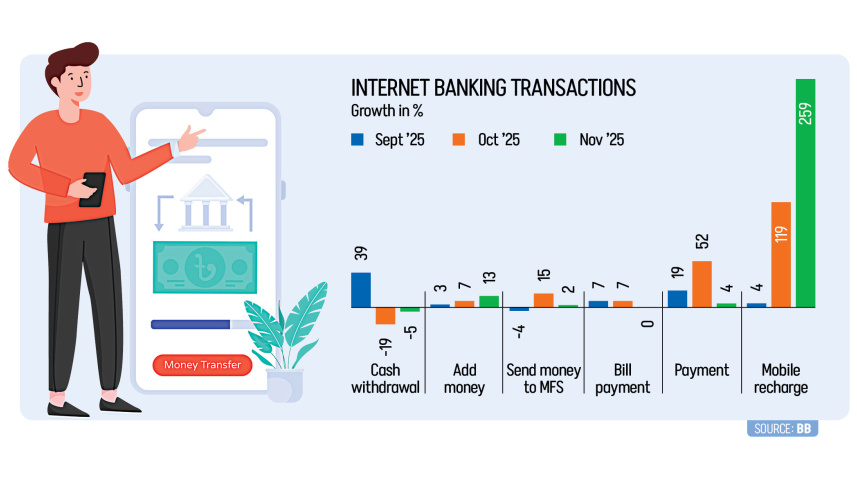

The central bank’s data also shows that internet banking for adding money to wallets, payments, mobile recharging and sending money through mobile financial services has been growing. Cash withdrawal through digital banking has been falling, indicating a growing preference for digital transactions over cash.

“This reflects increasing digital adoption by people. Apps are offering scope to customers to do banking while staying at home,” said Md Arup Haider, deputy managing director & head of retail banking at City Bank PLC, which has the Citytouch app.

“We, banks, are also adding newer features in the apps by understanding customers’ choices and preferences.”

Md Shafquat Hossain, deputy managing director and head of retail banking at Mutual Trust Bank PLC, said banks are encouraging customers to opt for digital banking to supplement the central bank’s goal of digital transactions.

The BB has set a target of settling at least 75 percent of retail transactions through digital channels by 2027.

“We are also pushing because digital transactions cut costs. Banks can position their employees in sales roles and provide better services to their clients,” he said. “This is benefiting customers too, as they can conduct banking anytime and from anywhere.”

He said his bank’s MTB Neo app has 2.8 lakh users and they recorded Tk 4,000 crore in transactions through its app last month.

“When a customer opens an account with us, we also open the app for them,” said the official, adding that the private bank aims to increase the number of its app users to 5 lakh by the end of this year.

Expressing optimism that digital transactions will increase, he said, “It is going to be a reality. Those who do not want to do internet banking will have to do so in the coming days.”

Md Mahiul Islam, deputy managing director and head of retail banking at BRAC Bank, said they offer BRAC Bank’s app Astha, launched four years ago. It has over 12 lakh users. The bank offers 120-plus integrated services, and the volume of monthly transactions through the app is Tk 20,000 crore.

“The need to visit branches for banking will reduce gradually. Cash transactions will fall,” he said.

Bankers said the risk of falling into the trap of fraud is there, and banks are enhancing the guardrails to protect customers.

EBL MD Iftekhar said that despite strong growth, several infrastructural and experience-related challenges need to be addressed to ensure long-term adoption and trust in internet banking.

“Simplifying and streamlining customer onboarding remains a key priority, as app-based banking usage is still largely concentrated in metropolitan areas. Limited digital literacy, particularly among rural and semi-urban populations, continues to slow wider adoption.”

In addition, inconsistent internet connectivity outside major cities, as well as rising cybersecurity and data protection concerns, present ongoing challenges for the digital banking ecosystem, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments