Janata Bank struggles while Sonali recovers

- Janata Bank crippled by massive defaults

- Sonali Bank strengthened through cautious lending

- Rupali, Agrani suffer high capital shortfalls

- Loan concentration poses systemic banking risks

Among the four state-run banks, the financial health of Janata Bank has deteriorated rapidly over the years due to massive loan irregularities and scams, while Sonali Bank is on a recovery mode thanks to a cautious approach to lending.

A decade ago, Janata Bank lost Tk 3,359 crore in the AnonTex Group scam, yet learned little and continued to overlook risky practices. In 2024, its loan exposure to Beximco reached around Tk 25,000 crore, crossing the single borrower limit, and a large chunk of it defaulted later.

But the trajectory of Sonali Bank differs.

After several lending scandals, including the largest in its history, worth Tk 2,700 crore in 2012, the state lender tightened its lending strategy and adopted more disciplined risk management.

According to performance reports submitted to the central bank, Sonali Bank shows the strongest financial health among the four state-run banks.

Its non-performing loan ratio, capital adequacy, large-loan concentration, cash recovery from bad loans, and liquidity position all outperform its peers.

Janata Bank, in contrast, faces a critical situation. Rupali Bank and Agrani Bank are also facing a crisis with high non-performing loans, capital shortfalls, large-loan concentration, and other weaknesses.

Since 2007, the Bangladesh Bank (BB) has set biannual performance-improvement targets for the four state-owned commercial banks.

These targets include cash recovery from defaulters, reduction of defaulted loan ratios, strengthening the capital base, credit growth, and profitability.

At the end of June this year, non-performing loans (NPLs) at Janata Bank stood at Tk 72,107 crore, representing 70.84 percent of its disbursed loans and posing a threat to its stability.

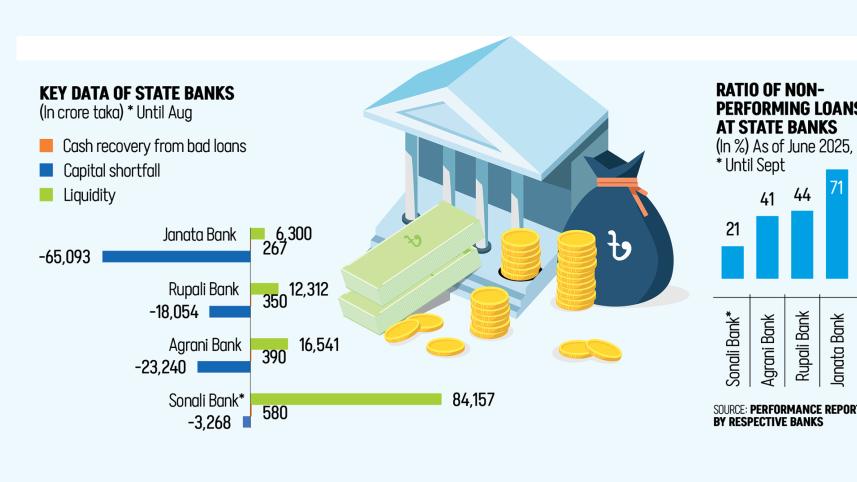

Between January and June this year, the bank's bad loans rose by Tk 4,218 crore. Rupali Bank and Agrani Bank also face severe challenges, with NPL ratios of 44.0 percent and 40.55 percent, respectively.

As of September this year, Sonali Bank maintains the lowest NPL ratio at 20.98 percent, making its asset quality relatively stronger, though still high by international standards.

All four state-run banks are facing large capital shortfalls caused by the high volume of bad loans. A capital shortfall indicates a bank cannot maintain the minimum regulatory capital against its risk-weighted assets.

As of June this year, Janata Bank was in the most precarious position, with a capital shortfall of Tk 65,093 crore, far higher than its peers and signalling a major solvency issue.

Agrani Bank and Rupali Bank reported shortfalls of Tk 23,240 crore and Tk 18,054 crore, respectively.

By contrast, Sonali Bank has a manageable shortfall of Tk 3,268 crore.

Between January and June, capital shortfalls declined at Sonali Bank and Agrani Bank but increased at Rupali Bank and Janata Bank.

Recovery efforts remain weak relative to the scale of bad loans.

According to the performance report analysis, Sonali Bank recovered Tk 580 crore in cash from defaulted and written-off loans during January to June, the highest among the four banks.

Agrani Bank and Rupali Bank recovered Tk 390 crore and Tk 350 crore, respectively, while Janata Bank, despite having the largest NPL volume, recovered just Tk 267 crore.

For the banks, a high concentration of loans among a few borrowers poses a systemic risk.

Janata Bank reported the highest concentration, with 76 percent of funded loans tied to 33 borrowers.

Rupali Bank has 63 percent tied to 32 borrowers, Agrani Bank 44 percent among 19 borrowers, and Sonali Bank the lowest concentration at 9 percent among five borrowers, according to the report.

In terms of liquidity, Sonali Bank holds Tk 84,157 crore as of August, indicating a strong ability to meet withdrawals and funding needs.

Liquidity at Agrani Bank, Rupali Bank, and Janata Bank is much lower, at Tk 16,541 crore, Tk 12,312 crore, and Tk 6,300 crore, respectively.

Janata Bank's low liquidity, combined with its capital shortfall, leaves it highly vulnerable, according to industry insiders.

Past loan irregularities, scams, and politically influenced lending under the previous government have undermined the financial health of Janata Bank, Agrani Bank, and Rupali Bank.

In contrast, a cautious lending policy following the Hallmark loan scam has helped Sonali Bank strengthen its position, according to industry sources.

Md Shawkat Ali Khan, managing director and CEO of Sonali Bank, told The Daily Star last week that since the Hallmark scam, the bank has invested more cautiously.

"Loans are no longer extended indiscriminately. In addition, priority is being given to the SME and agriculture sectors. These factors have contributed to the improvement in the bank's financial health," he said.

Regarding Hallmark Group recovery, he said the bank has identified and taken possession of 134 acres of Hallmark's land and is exploring ways to sell the assets.

"We have already spoken with Bida [Bangladesh Investment Development Authority], so they can bring in foreign buyers and facilitate the sale. We have also proposed that the government consider taking over the land," he added.

Hallmark's current liabilities at Sonali Bank total Tk 2,500 crore, with only Tk 13 crore recovered in cash so far.

"In some areas, we improved in the June quarter, but in some we failed," said Kazi Md Wahidul Islam, managing director and CEO of Rupali Bank.

"We are trying to reduce the bad loans," he commented, adding that the bank recovered a significant amount of bad loans in the June quarter.

The Daily Star approached the managing directors of Agrani Bank and Janata Bank for comment, but they did not respond till the filing of this report yesterday evening.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments