Remittance jumps 31% in November

- November remittance rose 31 percent year‑on‑year

- Inflows reached $13.03 billion July–November

- Manpower exports boosted remittance earnings abroad

- Forex reserves strengthened by rising remittances

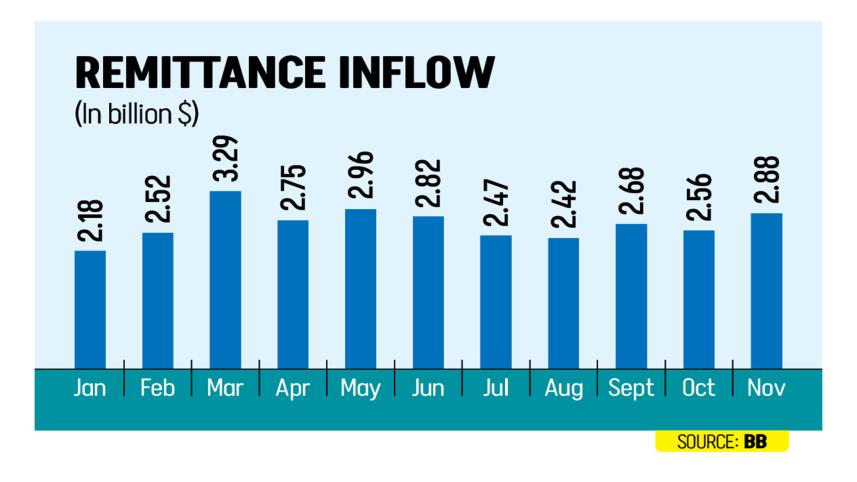

Remittance inflows to Bangladesh rose by 31.34 percent year-on-year to $2.88 billion in November, marking the highest in the last six months.

Expatriates had sent $2.19 billion home in the same month last year, according to the latest data from the Bangladesh Bank.

November's figure is also 13 percent higher than October's inflow of $2.56 billion.

Bangladesh has seen a growing trend in remittance inflows since December last year, driven by multiple factors, including a narrowing gap between official and informal exchange rates, industry insiders said.

During July to November of this fiscal year, remittance inflow reached $13.03 billion, up from $11.13 billion in the same period last fiscal year, the data showed.

The recent growth in manpower exports has also boosted remittance earnings. Over 40 lakh people left the country for jobs abroad in the four years ending in fiscal year 2024-25, according to the Bureau of Manpower, Employment and Training (BMET). Industry insiders said this migration will further increase remittance earnings in the coming days.

Bankers noted that as irregular or alternative payment methods are now under control, demand for US dollars has declined, reducing foreign currency transactions through hundi or informal channels. As a result, remittance inflows through banking channels are rising.

A senior central bank official said the regulator had warned commercial banks that it would no longer provide US dollar support, requiring banks to manage their own dollars for import payments.

This has encouraged lenders to make greater efforts to collect more remittances since the beginning of this year, he added.

In fiscal year 2024-25, remittance inflows crossed $30 billion for the first time, rising by a record $6.4 billion. Previously, the highest remittance received by Bangladesh was $24.8 billion in fiscal year 2020-21.

The country's foreign exchange reserves are now stable, supported by factors including high remittance inflows. As of November 27, forex reserves stood at $26.40 billion, up from $18.73 billion in the same period last year, according to Bangladesh Bank data.

Bankers said the growing remittance trend has helped boost forex reserves.

In November, Islami Bank Bangladesh received the highest remittance at $606 million, followed by Agrani Bank with $241 million, Janata Bank with $228 million, and Trust Bank with $147 million, the data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments